Freelance Day Rate Calculator (TJM)

freelance day rate calculator

1) Income goal

2) Work capacity

Advanced: billable days breakdown (optional)

3) Costs & buffers

| Target net income (annual) | €0 |

| Business expenses | €0 |

| One-time costs (year 1) | €0 |

| Taxes & contributions (est.) | €0 |

| Safety margin | €0 |

| Unpaid invoices risk | €0 |

| Conservative | €0 |

| Recommended | €0 |

| Aggressive | €0 |

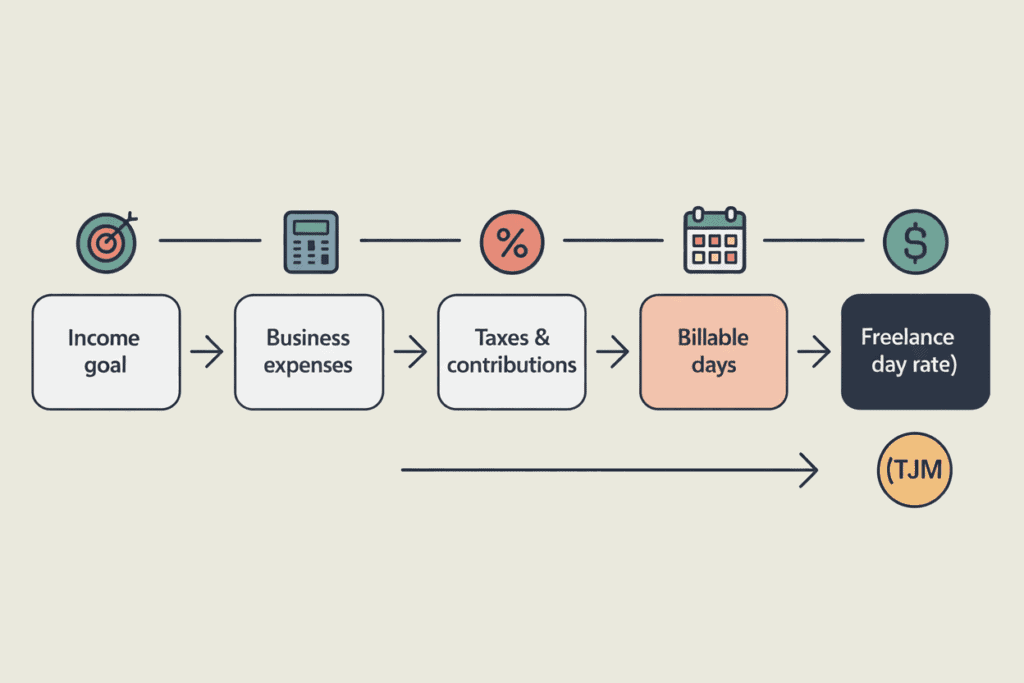

How does the Freelance Day Rate Calculator work?

This freelance day rate calculator (also known as TJM – Taux Journalier Moyen) helps you estimate a realistic daily and hourly rate based on your personal income goals, working capacity, business costs, and risk factors.

Instead of guessing a price or copying market averages, this tool works from the inside out:

- Start with how much you want to earn.

- Factor in how much you can realistically work and bill.

- Add expenses, taxes, and safety buffers.

- Calculate the revenue and rate required to reach that goal.

All calculations run locally in your browser. No data is sent or stored.

Step-by-step explanation of each field

1) Income goal :

Currency

Choose the currency you work with. This only changes the symbol (€ $ £ etc.), not exchange rates.

Target net income

This is the amount you want to earn for yourself, after expenses but before personal lifestyle choices.

Example:

- €4,000 per month

- or €48,000 per year

Target period (Monthly / Yearly)

Select whether your income goal is monthly or yearly.

The calculator automatically converts monthly goals into annual targets for consistency.

2) Work capacity

Working days per year

The total number of days you are theoretically available to work.

Typical values:

- 200 to 230 days per year

- 220 is a common default

Hours per day

Used to calculate your hourly rate from the daily rate.

Most freelancers use:

- 7 to 8 hours per day

Utilization rate (%)

This is one of the most important fields.

It represents the percentage of your working time that is actually billable to clients.

It accounts for:

- prospecting,

- admin,

- emails,

- breaks between projects.

Typical ranges:

- 60 % → conservative

- 70 % → realistic

- 80 % → very optimized

Unpaid invoices risk (%)

Optional buffer to protect you against:

- late payments,

- unpaid invoices,

- cash flow issues.

Even a small value (2–5 %) can significantly improve realism.

Advanced: billable days breakdown (optional)

This section helps you validate your utilization rate using real-life constraints.

You can enter:

- vacation and holidays,

- sick days,

- admin and accounting time,

- marketing and prospecting days.

The tool compares this breakdown with your utilization input and warns you if there is a large mismatch.

This makes the result much more credible.

3) Costs & buffers

Annual business expenses

Everything required to operate your activity:

- software,

- hardware,

- insurance,

- coworking,

- ads,

- tools.

One-time costs (year 1 only)

Optional costs such as:

- laptop purchase,

- training,

- business setup.

Taxes & contributions (%)

Estimated percentage for:

- income tax,

- social contributions.

This varies by country and legal status.

If unsure, use a conservative estimate (25–35 %).

Safety margin (%)

Extra buffer for:

- slow months,

- unexpected costs,

- stress reduction.

A margin of 5–15 % is common for freelancers.

Understanding the results

Recommended day rate (TJM)

This is the daily price you should charge to realistically reach your income goal.

Recommended hourly rate

Automatically calculated from:

- day rate,

- hours per day.

Useful if clients ask for hourly pricing.

Billable days (estimated)

The number of days you are expected to invoice during the year, based on your utilization rate.

Required annual revenue

The total turnover you need to generate to:

- pay expenses,

- cover taxes,

- include buffers,

- reach your net income goal.

The 3 scenarios explained

The calculator provides three pricing scenarios:

Conservative

Higher safety margins and lower utilization.

Useful when:

- starting out,

- working with unstable clients.

Recommended

Balanced and realistic for most freelancers.

Aggressive

Higher efficiency and lower buffers.

Suitable for:

- experienced freelancers,

- strong positioning,

- high demand niches.

These scenarios help you adapt your pricing strategy depending on your market.

Example calculation

Let’s say you want:

- €4,000 net per month,

- 220 working days per year,

- 70 % utilization,

- €4,000 yearly expenses,

- 30 % taxes,

- 10 % safety margin.

The calculator shows that you should charge approximately:

- €540–550 per day

- €65–70 per hour

This ensures you are paid fairly without underpricing your work.

Frequently Asked Questions

Is this tool accurate?

It is an estimator, not financial advice. Accuracy depends on how realistic your inputs are.

Does it include VAT?

No. VAT or sales tax is usually added on top of your rate depending on your country.

Can I use this tool for any country?

Yes. The logic is universal, but tax rates must be adjusted manually.

Is my data stored?

No. Everything runs locally in your browser.

To explore more free tools designed for freelancers, writers, and digital creators, visit our

Free Online Tools

section on Scriptobits.

For country-specific tax rules or legal advice, we recommend consulting your local tax authority or a certified accountant, or referring to official resources such as the

OECD tax guidelines

.